- #BED BATH BEYOND STOCK LONG TERM OUTLOOK 2018 UPDATE#

- #BED BATH BEYOND STOCK LONG TERM OUTLOOK 2018 FULL#

- #BED BATH BEYOND STOCK LONG TERM OUTLOOK 2018 WINDOWS#

Near-term and ongoing gross margin improvements through changes in assortment mix to drive sales to better margin categories modifications in pricing algorithms further optimization of coupon strategy and supply chain improvements.

#BED BATH BEYOND STOCK LONG TERM OUTLOOK 2018 WINDOWS#

#BED BATH BEYOND STOCK LONG TERM OUTLOOK 2018 FULL#

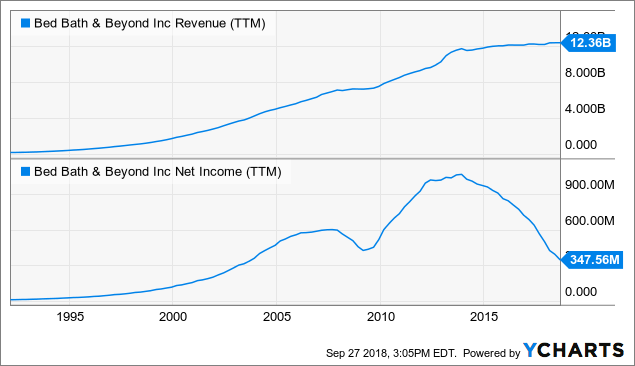

Comparable sales in the fiscal 2018 full year declined approximately 1.1% and included strong sales growth from the Company's customer-facing digital channels, and sales from stores that declined in the mid-single-digit percentage range. Net sales for the fiscal 2018 full year were approximately $12.0 billion, a decrease of approximately 2.6% compared to the prior year, primarily due to one less week in the year compared to fifty-three weeks in fiscal 2017.

Excluding the non-cash impairments charge, the Company reported adjusted net earnings of $2.05 per diluted share ( $275.4 million) for the fiscal 2018 full year. Comparable sales in the fiscal 2018 fourth quarter declined approximately 1.4% and included strong sales growth from the Company's customer-facing digital channels, and sales from stores that declined in the mid-single-digit percentage range.įor the fiscal 2018 full year (52 weeks), the Company reported a net loss of ($1.02) per diluted share ( ($137.2) million), which included a non-cash goodwill and tradename impairments charge, compared with $3.04 per diluted share ( $424.9 million) for the fiscal 2017 full year (53 weeks). Net sales for the fiscal 2018 fourth quarter were approximately $3.3 billion, a decrease of approximately 11.0% compared to the prior year period, primarily due to one less week in the quarter compared to fourteen weeks in fiscal 2017 and a shift in the calendar, moving the post-Thanksgiving holiday sales week out of the fourth quarter. Excluding the non-cash impairments charge, the Company reported adjusted net earnings of $1.20 per diluted share ( $158.8 million) for the fiscal 2018 fourth quarter.

#BED BATH BEYOND STOCK LONG TERM OUTLOOK 2018 UPDATE#

In addition, the Board of Directors of the Company provided an update on its Board refreshment and governance review.įor the fiscal 2018 fourth quarter (13 weeks), the Company reported a net loss of ($1.92) per diluted share ( ($253.8) million), which included a non-cash goodwill and tradename impairments charge, compared with $1.41 per diluted share ( $194.0 million) for the fiscal 2017 fourth quarter (14 weeks). The Company also provided an update on its comprehensive transformation plan, including short-and-long-term financial targets.

(Nasdaq: BBBY) today reported financial results for the fourth quarter of fiscal 2018 ended March 2, 2019. UNION, N.J., Ap/PRNewswire/ - Bed Bath & Beyond Inc.

0 kommentar(er)

0 kommentar(er)